by Kara Herbeson | Jan 3, 2025 | Blog, Finance

The beginning of a new year offers hope for a fresh start to many aspects of our lives, including our finances. Refinancing your mortgage and putting your home equity to use may be the best way for you to start the new year off right and help build future wealth....

by Kara Herbeson | Dec 20, 2024 | Blog, Finance

For many Canadians, buying a first home is an important milestone that requires careful planning and substantial savings for a down payment in order to achieve. With the rising cost of housing and living expenses, however, saving enough money can feel like an...

by Kara Herbeson | Aug 2, 2024 | Blog, Finance

Many mortgage borrowers are weighing their options when it comes to debt consolidation to help ease monthly financial obligations, which can empower you to both save money and improve your cashflow in one move. Accessing home equity is a popular and cost-effective way...

by Kara Herbeson | Jul 5, 2024 | Blog, Finance

College and university residence spaces and local rental opportunities are tight in many areas with concentrated amounts of student population. That’s why it may be a great idea to consider buying a home for your child and their friends/roommates to live in while...

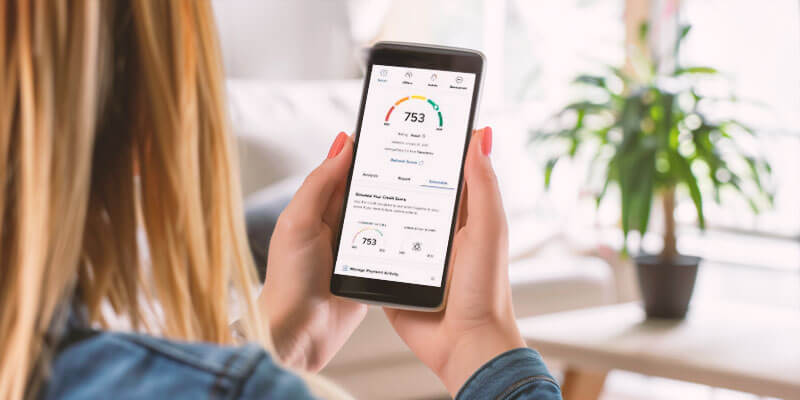

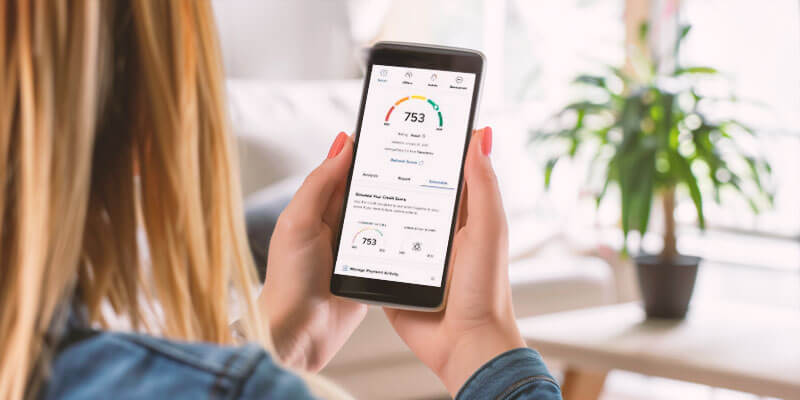

by Kara Herbeson | May 17, 2024 | Blog, Finance

When it comes to improving your credit score, your mortgage agent can be an invaluable ally. A higher credit score not only qualifies you for better mortgage rates, but it also opens the door to a variety of financial opportunities. Let’s face it, sometimes life...

by Kara Herbeson | Dec 1, 2023 | Blog, Finance

In the spirit of the holidays, it’s easy to get caught up with the excitement of festive decorations, gift-giving, entertaining and gatherings with loved ones. But it’s important to stay on budget so you start 2024 off without financial regrets. Following are some...